Cars Import Duty in Malaysia

Import duties run to as high as 300. Up to 80 cash back When shipping a package internationally from Malaysia your shipment may be subject to a custom duty and import tax.

Read This Before You Buy A Car This Year Comparehero

As compared to when youre purchasing a luxury car these cars are a bit more on the affordable side.

. Egg in the shells. Used Audi A4 can be found in Malaysia at a pretty affordable price. Live animals-primates including ape monkey lemur galago potto and others.

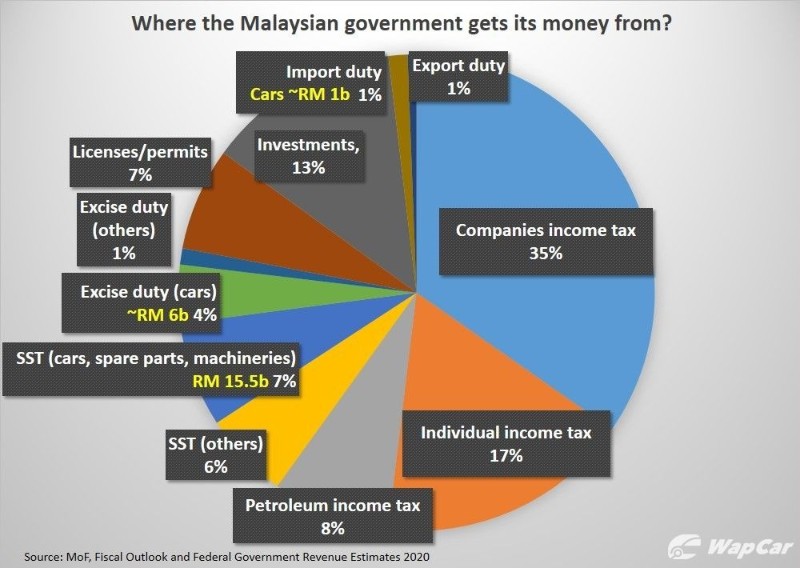

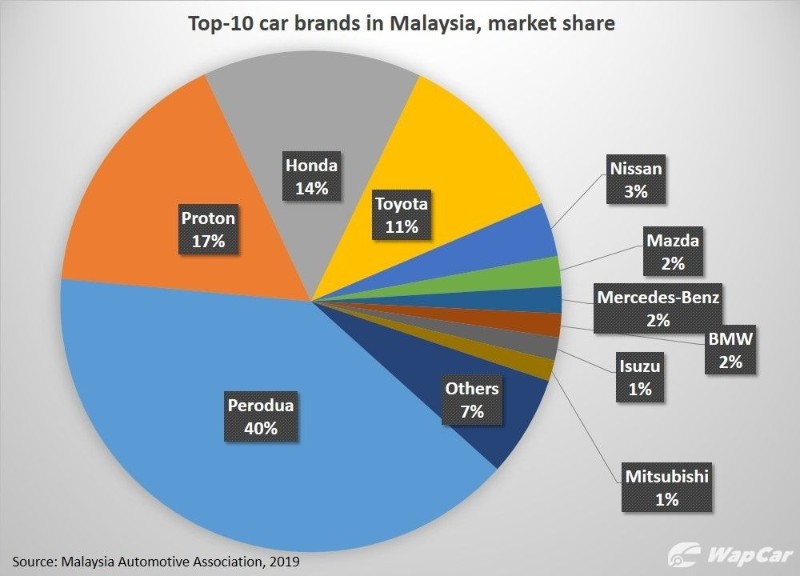

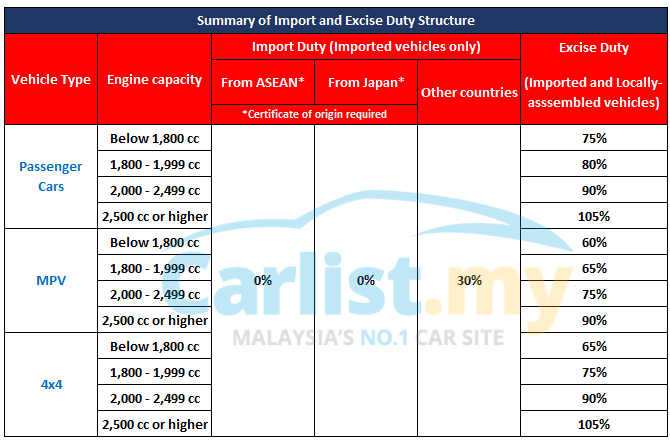

KUALA LUMPUR Dec 31 Reuters - Malaysia cut import duties on cars on Wednesday a year ahead of schedule but imposed excise duties of 60-100 percent to help offset the revenue fall. Cost of maintenance and parts for foreign cars are also factors to be considered. The imposition of very high import duties make owning a non Malaysian made car somewhat expensive.

One interesting thing to note here is how the Haval H2 is actually cheaper here in Malaysia but because of the taxes Malaysians still end up paying more than their Chinese. Consequently the vast majority of cars in Malaysia are locally produced ones. Consequently the vast majority of cars in Malaysia are locally produced ones.

Start Shipping To Malaysia With Confidence. Have a valid work permit for the country. To calculate the import or export tariff all we need is.

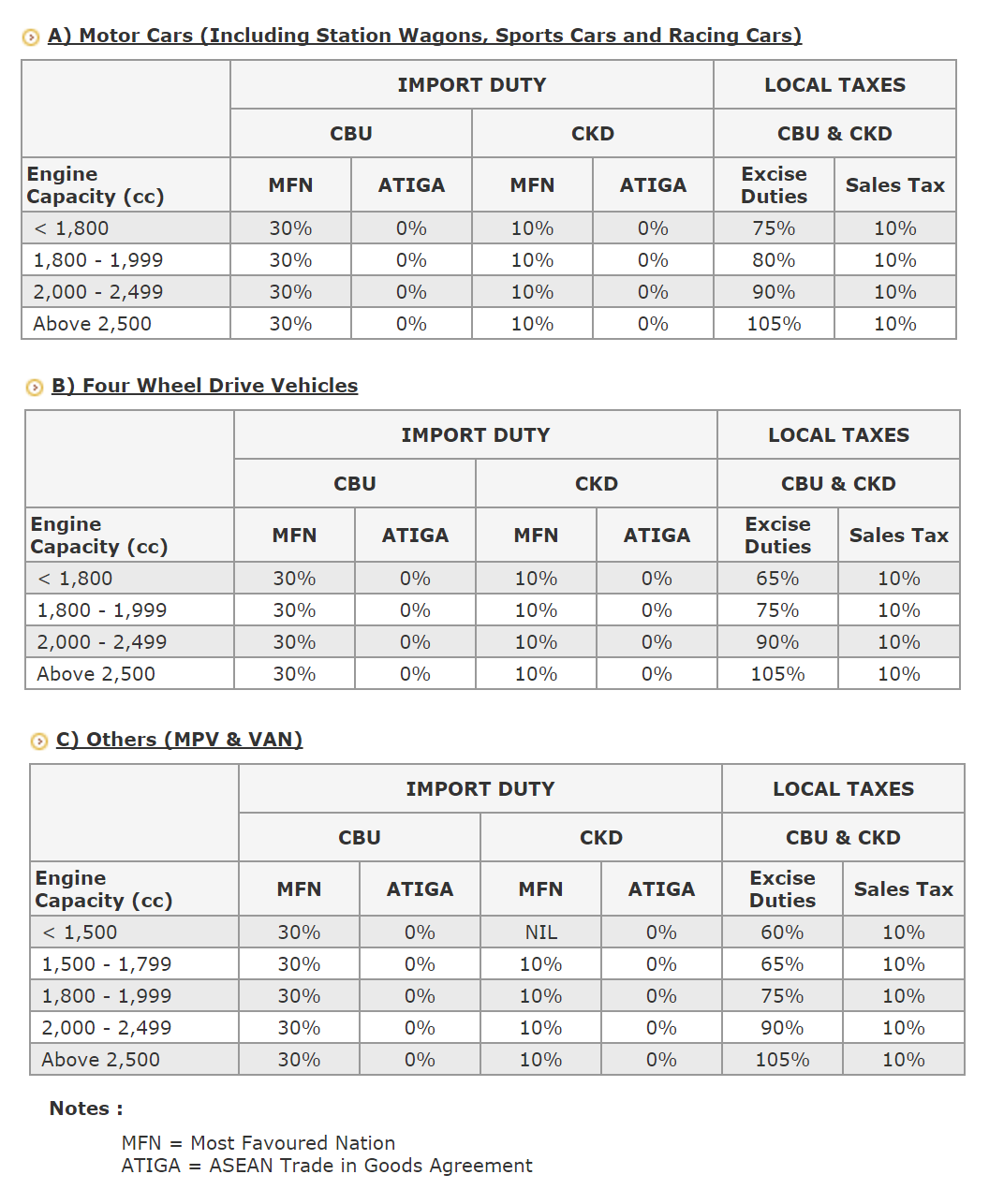

Import duty on various car segments according to their CIF values. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities. Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574.

The MAA anticipates a 2. Some goods are not subject to duty eg. CIF Value of goods - RM3000000.

It is also expensive to buy parts for foreign cars making them difficult to maintain. SALES TAX10 of the sum of CIF value of the car and the import duty will be charged as sales tax. Needless to say if your car is rare or indeed not available in Malaysia.

The Customs department of Malaysia has their own method of calculating the open market value of certain vehicle models. Importation of CBU Motor Vehicle Transported to Licensed Warehouse Import Duty Excise Duty and Sales Tax to be paid at the time when there is a buyer and motor vehicle transported out of the warehouse. A person who chooses to import a car to the country needs to meet the following conditions.

Goodada can help you with your Malaysia Import and Export Duty Clearance. In addition to duty imports are subject to sales tax VAT and in some cases to excise. Excise duties collection in 2020 is expected to increase 49 to RM 11 billion due to higher demand for motor vehicles.

So important are cars to the Malaysian Treasury that in the Ministry of Finances MoF Fiscal Outlook and Federal Government Revenue Estimates 2020 document the Ministry actually said. Hundreds of Japan used cars imported in Malaysia in the year of 2018. Conditions that need to be fulfilled to qualify for an Import License for a private motor vehicle.

Import duties can be much more than a cars value. The value of your order. Vehicle must be registered under the applicants name for a period of not less than nine 9 months from the date of vehicle registration to the date of return to Malaysia.

Toyota Vellfire is sold by Toyota along with Alphard to Malaysia. The custom duty will basically depend upon the declared value of the car that is being brought into the country. IMPORT DUTY ON 4X4 VEHICLES AND OTHERS 60 of the CIF value will be charged for vehicles having up to 1799cc engine.

With a tax rate of 75 though were still on the higher side when it comes to being taxed. To import your car to Malaysia you must apply for an Approval Permit. Laptops electric guitars and other electronic products.

1 January 2019 C COMMERCIAL VEHICLES IMPORT DUTY LOCAL TAXES CBU CKD CBU CKD IMPORT DUTY LOCAL TAXES CBU CKD CBU CKD LOCAL TAXES B OTHER MOTOR CARS. Importing a car into Malaysia is very expensive. This sales tax exemption on purchases of new vehicles was previously granted from 15 th June 2020 until 31 st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when the.

Import duties run to as high as 300. We have noticed an unusual activity from your IP 207461361 and blocked access to this website. Please confirm that you are not a robot.

Needless to say if your car is rare or indeed not available in Malaysia these factors become paramount. Shipping Rates Based On. Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry.

Every country is different and to ship to Malaysia you need to be aware of the following. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars. Our Malaysia Customs Broker can assist you to calculate import and export Duty charges.

Please refer to Royal Malaysian Customs Department for official confirmation. Direct import concept solution D concept car import tax malaysia car import agent Malaysia car import rules and regulations car import duty import car from australia to Malaysia malaysia car import tax calculator how to import a car shipping car to malaysia recond car AP car car from japan car from uk car from australia vehicle import duty importing a vehicle can i import a car. Malaysia to Malaysia Dimension of 10x10x10 cm.

JPY 100 RM 33000 Exchange rates are updated every Sunday following CIMB rates Full Breakdown. Residing overseas legally for a period of not less than one 1 year. Importation of CBU Motor Vehicle Transported to Licensed Warehouse Import Duty Excise Duty and Sales Tax to be paid at the time when there is a buyer and motor vehicle transported out of the warehouse At the time of importation.

MAA shall not be liable for any loss caused by the usage of any information obtained from this web site Updated. Toyota Mark X Toyota Land Cruiser Honda Fit and some more are also very popular as used car in Malaysia. Excise duty is between 60 and 105 regardless of CKD or CBU calculated based on the car and its engine capacity while import duty can reach up to 30 depending on the vehicles country of.

The import duty on passenger cars with petrol engines range between 140 and. Sales Tax 10 RM 643500. Cost of maintenance and parts for foreign cars are also factors to be considered.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Here S What 2019 Imported Cars Cost Before Taxes In Malaysia

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Importing Cars In Malaysia Expatgo

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

Comments

Post a Comment